Challenger Tech

Challenging Challenger

Company Profile

Incorporated in 1984 and listed in SGX on 14-Jan-2004. Challenger Technologies operates a chain of I.T. retail stores. The company also own LED signage & service provider CBD eVision Pte Ltd and integrated marketing provider inCall System Pte Ltd.

Financial

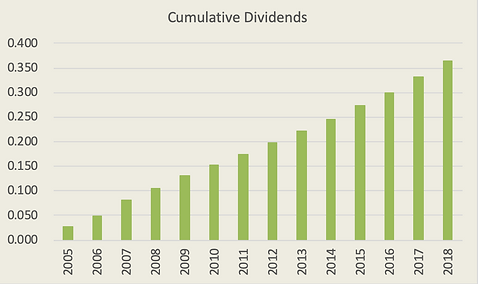

Revenue grew at a CAGR of 22% from 2005, peaking in 2013. From thereon, revenue started to trend down. The company had been generating positive operating cash flow; allowing her to pay dividends consistently. In the last fourteen years, Challenger paid a total dividends of 35 cents and share price have increased from IPO price of $0.133 to $0.567 today. Management have done an excellent job since going public.

Privatisation

On 20-Mar-2019; the company proposed to delist / privatise the company at $0.56.

Pangolin Asia Fund and minority shareholders claims that the offer price to privatise is too low.

Pangolin expectation of a fair price should be at least $1.15 based on free cash flow and cash on balance sheet.

Rationale for privatisation:

i. Opportunity for shareholdeers to exit at premium

ii. Low trading volume,

iii. Greater management flexibility

iv. Challenging retail environment. Dividends could be affected

v. No need for access to capital market

vi. Cost of listing.

Public company, Towkay mindset

Of the six reasons given for privatisation; only the fourth is meaningful to shareholders.

Major shareholders already own more than 50% of the company. There is great management flexibility. Saving from dividends to minority shareholders and listing cost will at most save a couple of million dollars. Privatisation will not change the circumstances.

Key Issue

Key issue confronting the firm is a changing retail marketing & distribution landscape. The existing business is a Cash Cow in management speak. Eventually cash cow will come to pass.

Grow or vanish

What the company need is to maintain her public company status to attract talents and options to tap various sources of fund to enable the company to explore new markets, new products, diversification or M&A. Challenger must think beyond her existing business to thrive.

UPDATE

On 27-Jun-2019 minority shareholders voted down Challenger proposed delisting.