Food Empire

TOUGH TIMES AHEAD

Financial

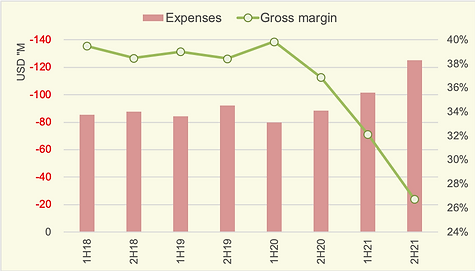

FY21 revenue grew 17% to $320M and profit fell 27% to $19.5M. Gross margin fell sharply from 38.3% to 29.3% from FY20-21 due to higher depreciation on commencement of India second coffee plant and higher material & labour cost. Margin pressure started as early as 2H20. Gross margin hit a new low of 26.7% in 2H21.

Russia - Ukraine Conflict

War between Russia-Ukraine started on 24-Feb-2022. This will compound the company challenges in the medium term.

Ukraine contribute about 10% of revenue and has suffered much damages in major cities during the first three weeks of war. Presently, more than 3 million of her citizens are seeking refuge in Western Europe.

As for Russia, punishing sanctions is causing mayhem in her financial systems and economy. Russian constitute 36% of Food Empire revenue.

Tough Times Ahead

Unlike sanctions on Russia for her annexation of Crimea in 2014, this financial and economic punishment on Russia by U.S.and Europe is extremely intense. The country is cut off almost completely from SWIFT, with broad sanctions on leaders and oligarchs. More than 300 companies have also ceased operation in the country.

Ruble devaluation will lead to high inflation and diminished disposal income. Middle class are also migrating to Western economies.

Resilience

In 2014, Russia & Ukraine contribute about 66% of Food Empire revenue and CIS 19%. By FY21, revenue risk is diminished with South East Asia, South Asia and Others expanding to 41% of revenue. While this provides some relief; sharp decline in business from Eastern Europe will certainly cause much distress to the company in the medium term.

In 2014, the firm had cash of $20M and debt $42M. In 2021 Food Empire cash stood at $61M with $52M debt. Current ratio is 2.4. A healthier balance sheet should enable the company to ride through this difficulty.

With Western companies exiting the Russian market, Food Empire may eventually benefit from increasing share of business but possibly on a smaller market due to property destruction and migration.

FOOD for THOUGHT

Food Empire manufactures and market instant beverages, frozen convenience food and confectionery. Products are sold in over 50 countries. Served markets include Russia, Eastern Europe, Central Asia, Indochina, Australia and United States.

A story of Resilience

Flagship product MacCoffee was founded in 1994, the same year Tan Wang Cheow launched the brand in the Russian market. The firm has a 50% market share in Russia in the instant coffee mix segment.

In its 35 years history, it survives the global financial crisis when sales plunges 39% and net income fell by 87%. 2014 sanction over Ukraine incursion and Crimea annexation caused the Ruble to depreciate from 27 to 85 to a dollar; forcing the firm to record a loss. For the past year, Ruble had been cycling between 56~70. It is currently at 65~66.

Perseverance

Despite macro events beyond its control, Food Empire remain focused, expanding into Indochina and different parts of the world. To appreciate the company underlying strength: Russia revenue mixed have reduced steadily from FY2004 61% to 40% in FY2018 but revenue grew from US$70M to a steady US$110M the past few years. Total revenue CAGR since FY2004 was about 7%. Gross and net margin have been improving as well.

Growing (chart 1)

Sales in FY18 grew 6% to USD284M.

Gross margin continue to trend up from FY17, 38.3% to 39.0% in FY18.

Forex impact was US$3.5M.

Allowance for doubtful debt in 4Q18 was US$3.0M (US$99K in FY17).

Net income increased 28% to USD18M.

Net margin increased from 5.2% to 6.4%.

Note: As at 28Feb18; RUB is 4%~5% stronger vs Dec18. UAH and KZT are < 2% higher..

Expansion (chart 2 & 3)

To mitigate geographical & currency risk, the company had been expanding into Indochina and Other Markets (likely the Middle East).

The firm is also expanding its capacity, in particular the India instant coffee plant to support her growth ambtion.

Caffebene, stock price & P/E

The firm invested in Caffebene in early 2016. Had to write-off its investment recording a loss in 4Q17. As a result stock price trended lower. 4Q17 losses is also the reason why financial systems were flagging a lagging P/E of 18.

Post FY18 financial results; P/E should fall to about 10~11 @ $0.55 when all systems are updated.

Strategic Implication

The company is an attractive acquisiton target for the following reasons:

a. Presence and major market shares in Eastern Europe and Indochina.

b. Growing revenue and expanding profit.

c. Capacity expansion in relatively low cost countries:

- Malaysia (Ringgit): Snacks and non-dairy creamer.

- India (Rupee): Instant coffee plant operational since Dec15.

- India: Significant expansion of existing instant coffee plant by 2020.

d. Option to service the India market in a substantial way.

e. Current P/E of 10~11 is exceedingly attractive to Acquirer.

Supergroup P/E was in the 20s @ S$0.97 when JDE acquired for S$1.30.

Notes on 19Aug2019 - Tailwind

2Q19 Net earning increased 140% from US$2.3M to US$5.6M despite revenue softening by 2% due to forex translation. 1H-2019 net earning increased by 39%.

Of significance was Sales/Distribution improving from 6.1 (average 2015-2018) to 7.0 in 1H-2019.

This productivity gain appear to have started in 2017 @ 6.8.

However higher A&P for 2018 FIFA World Cup held in Russia and entry to Myanmar market clouded this improvement @ 5.9.

Post key events in 2018 and rationalisation; Sales/Distribution improved to 7.0 in 1H-2019.

Forex in the past 12 months have stabilised within a narrow bandwidth.